There’s been a lot of noise in the markets lately: tariffs, geopolitics, AI breakthroughs, Southeast Asian tech scandals, war. The list goes on. It feels endless. As an investor, it makes you wonder: When will it all settle down? And more importantly, when is the right time to get in—or out?

Charlie Munger had two good sayings:

“The big money is not in the buying or the selling, but in the waiting.”

and

“The first rule of compounding: Never interrupt it unnecessarily.”

Two months ago we heard Buffett talk about his strategies at the Berkshire Shareholder Meeting and we can be sure of one thing: his view of the long run will never change, and neither will his strategies for compounding.

What I find amazing about the Berkshire model isn’t so much their financial acumen. Most of what they do (from a technical perspective) is basic math and common sense when it comes to valuing companies and picking strong leaders. Yes, Buffett took value investing to the next level, and most of its core concepts are now taught in every MBA program and well known on Wall Street. Even some of the top private equity firms are starting to follow his model.

You do need some degree of financial knowledge, but it’s not rocket science, and it can be learned by anyone who’s even moderately curious. The real edge of Berkshire is its philosophy: a philosophy rooted in long-term thinking and compounding. That’s something I’m not sure can be taught.

What is long term thinking? Every decision is made with an eye not for the short term (within 5 years), but for the long run (20+ years). They know that money cannot be made overnight. They know that most most people can’t seem to follow this rule and prefer to buy and sell stocks like a casino, which becomes an edge for those who do and can see through that noise. As Munger once said, “It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.”

They don’t panic when things go sour, or get excited when markets are up. When their neighbors say Bitcoin is going through the roof, or that the world is collapsing because of war, they stick to their guns and hold their ground with fundamentally strong businesses. Some of which may seem boring to most.

Most people want quick money. They want to see dividends and exits quick. Get their money back. The view of Berkshire is that cash is a form of credit for wealth creation (owning assets), so they see it as a form of energy to create more wealth (something Garry Tan explains well). Not the other way around where cash is an end-state. Yes, Berkshire holds $300b + in cash at the holding company level, but that is meant to be redeployed. That’s why everyone is wondering what they will do next with that money.

This brings me to the next question—and as a tribute to Buffett and Munger—are there other areas in life where this rule applies? Does this philosophy hold true beyond investing? I believe it does:

You don’t get healthy overnight by eating a single bowl of salad. You get healthy by doing it consistently over a long period of time.

You don’t build stamina after one hard workout. You build it by showing up to the gym consistently over a long period of time.

Your mind doesn’t grow stronger by reading one book in a week. It becomes stronger through consistent reading over the course of your life.

You don’t become skilled by treating college as the only time to learn. You become skilled by learning continuously, indefinitely.

You don’t become wealthy by speculating in the stock market, buying and selling at the mercy of Mr. Market (and the news). You become wealthy by investing and holding for the long term.

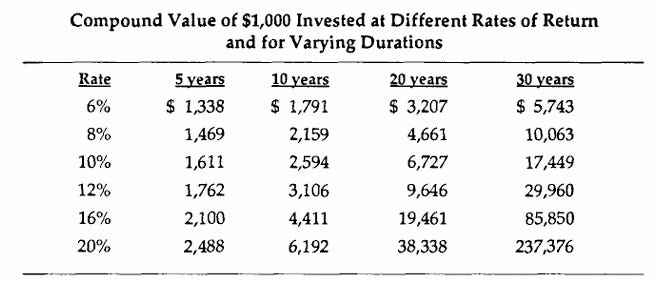

Seth Klarman, another respected value investor, wrote a book called Margin of Safety. And in it he shows the following table:

Greedy, short-term-oriented investors often forget the laws of compounding—and how powerful even small returns can be over a long period of time. It can be mind-boggling.

In short, the law of compounding says that over a long period of time, doing something consistently—no matter how small—can lead to large outcomes. The key word here is consistency. It’s the secret behind Berkshire’s success in investing, but Buffett and Munger often connect it to life as well. And yet people still wonder why so few follow it.

Well, it’s not easy. And nothing worth having in life ever is. But if you focus on the small wins, time becomes the most valuable edge anyone can have. So start now, and stick with it.

ABOUT THE AUTHOR

Keenan Ugarte is Managing Partner at DayOne Capital Ventures, an independent private holding company that invests in and builds high-growth, early-stage businesses that serve the underserved Philippine mass market. He is also the Co-Founder of The Independent Investor, a media platform spotlighting early-stage companies and innovation within the Philippine startup ecosystem.