I came across an interesting post on Twitter (sorry X.com) from Finding Compounders, which breaks down the competitive advantages of a company. These competitive advantages result in three types of outputs: (1) higher prices, (2) lower costs, and (3) efficient use of capital. While these outputs are simple to understand, they are not as easy to achieve. For simplicity’s sake, in this article, I will be using the word 'product' to define both goods and services.

What is the difference between a competitive advantage and an economic moat? Some people use them interchangeably, but there are clear differences between the two that entrepreneurs should know.

Here is a definition of a competitive advantage from Investopedia:

Competitive advantage refers to factors that allow a company to produce goods or services better or more cheaply than its rivals. These factors allow the productive entity to generate more sales or superior margins compared to its market rivals. Competitive advantages are attributed to a variety of factors including cost structure, branding, the quality of product offerings, the distribution network, intellectual property, and customer service.

- Investopedia

What this says is that companies need to have an advantage in cost, branding, quality, distribution, intellectual property, and customer service to have a competitive advantage.

So, how is this different from an economic moat? An economic moat was popularized by Warren Buffett when he tried to explain what gave companies a long-term competitive advantage. That is, what made companies continue their competitive advantages for a long time? And what allows them to stay profitable for the foreseeable future? Since he is a long-term investor, these moats are extremely important.

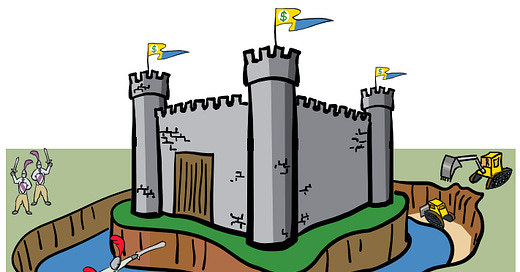

According to Wikipedia, the word 'moat' in the literal sense means 'a deep, broad ditch, either dry or filled with water, that is dug and surrounds a castle, fortification, building, or town, historically to provide it with a preliminary line of defense.' They were used by castles to defend their territories from siege weapons and battering rams that are only effective when brought up against a wall. The water and sometimes mud would make these weapons useless and prevent enemies from attacks. They proved to be effective.

Picture taken from Seeking Alpha

Of the three main sources of competitive advantages, the first is High Prices.

High Prices

High prices are something that customers face and are driven by customer demand. What makes a customer pay a premium for a product? According to the book "Pitch the Perfect Investment" by Paul Sonkin, there are three main factors that drive high prices: search costs, switching costs, and habit.

Search costs occur when it takes time and effort for a customer to find a desired product. When a customer considers purchasing something, they first consider how they can acquire it. If it is a necessity and not easily accessible, it creates an opportunity for a business to enter the market and command a high price. Over time, other competitors will observe the profitability and start matching or offering a similar product. From this point on, search costs begin to decrease, resulting in more competition and better options for the consumer.

For a moat to occur, the product being offered has to continue selling at a high price despite threats of new entrants, and this is where branding, service, and quality come in. Besides regulation (which causes monopolies to form), the only way a company can maintain its higher prices is either through branding, quality, or service. This is where companies like Starbucks and Tiffany’s shine. Starbucks can command nosebleed prices of almost $3.26 per latte in the Philippines, where GDP per capita is only $3.5k. That is the same price being offered in the US, where the GDP per capita stands at $63.5k.

Source: Visualcapitalist

They have been maintaining these high prices despite the rise of more affordable coffee options in emerging markets. It is quite obvious that Starbucks has a moat that is driven by its brand. When I say brand, I mean not only design, but also its complete store experience and customer service. I would argue that product quality is less of a factor since most of their beans are over-roasted and commercial grade. This doesn’t seem obvious when you walk into a well-lit store, greeted by accommodating staff, surrounded by well-placed chairs and sofas, a strong scent of roasted coffee filling the air, with beautifully designed packaging, and a carefully placed logo of the white mermaid staring at you.

Strong Brand + High Quality Experience —> Trust and Loyalty —> Higher Prices.

The next is switching costs. Switching costs are similar to search costs, but the main difference is that switching costs relate to the level of difficulty for a customer to switch from one product to another once they have already started using the product. A typical company that fits this mold is your local telco or bank. Once you start banking with a group or use a specific telco for mobile services, despite all the pain in dealing with them, we still continue using them. Why? Besides the fact that they tend to be oligopolistic and in highly regulatory spaces (which can also add to the moat), the switching costs are high. It is exhausting to cancel your telco plan, speak to another representative of another company, who will then send a bunch of forms that you have to fill up, and ask for more documents while making you wait on the line. On top of that, you will have to let all your friends know to switch to your new number. We tend to believe that the pain of continuing with the existing provider is the same as that of another provider, but this time you would have to face the high costs of switching over.

We face the same pain dealing with banks. In the US, you have companies like Microsoft, CRM software such as Salesforce and HubSpot, and Bloomberg, which provide critical services where the network effects are so strong that it is impossible to switch once you start using them. The cost of switching becomes so prohibitive that it ends up being higher than the cost of continuing with your existing provider.

More interdependencies —> High Switching Costs —> Higher Prices

The final factor for high prices is habit. Habit is an interesting one, and it assumes that people are irrational. Why? Because if a product can offer something that fits into the habits of a person (or business) you are selling to, it will continue to sell despite increasing prices, even though it makes sense to try another product. If a person has a certain process of buying something and prefers your product over others, then they will likely keep buying from you even if prices increase. This could be your local barbershop, or a certain beer that you really like that’s sold in your neighborhood liquor store, the local dentist who is right around the corner and spends time talking to you, or your preferred toothpaste brand (like Colgate) that sticks out on every grocery aisle.

According to Nir Eyal, the key is to build in effective triggers and make actions as easy as possible. The way to do this is to balance customer investments (rewards) with convenience (how easy it is for them to engage with you and complete an action). An example of this is Amazon. When Amazon started, people thought they would be wiped out by incumbents like Wal-Mart, but they kept on going. Jeff Bezos knew that customer loyalty was everything, and he focused on keeping customers happy, even if it meant losing money on specific transactions. Even today, if you complain about a product delivered by Amazon, they will immediately give you a refund without question.

Amazon is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking. Amazon strives to be Earth’s most customer-centric company, Earth’s best employer, and Earth’s safest place to work.

Amazon Guiding Principles

The two words that stand out here are customer obsession and long-term thinking. Keep in mind that Amazon was unprofitable for 10 years before turning a profit. This was the price paid for developing the habits that eventually turned it into the $1.8 trillion company it is today.

Customer Investments (Obsession) —> Customer Convenience —> Higher Prices

We have gone through the factors that drive high prices. In the coming days, we will look at those that impact the other two outputs: lower costs and efficient working capital.

Stay tuned…

ABOUT THE AUTHOR

Keenan Ugarte is Managing Partner at DayOne Capital Ventures, an independent private holding company based in the Philippines that partners with entrepreneurs across a wide range of industries. He is the Co-Founder and Director of The Independent Investor.