Portfolio Management for Founders

Being a founder means understanding what it means to be wealthy

I recently had a conversation with someone who asked me an interesting question. I told him that I met with a very promising entrepreneur who took the bus every day and drove a simple car, and had a simple watch, despite him having immense wealth from a business he owned. I always respect frugality in founders and it is a trait that I believe spills over to how a business is run. The person I told looked at me and asked “If he is so wealthy, why doesn’t he have a nice car or a nice home?”

This wasn’t the first time I’d heard that kind of question. I’ve encountered it countless times, and it makes me wonder whether most people truly understand the concept of wealth.

Questions like that made me realize something: that many people—if not most—don’t really understand what it means to be wealthy.

And it led me to another question: If entrepreneurship is a highly illiquid (low income) but a highly lucrative path, does it mean that most entrepreneurs understand the concept of wealth?

Here’s a simple question I like to ask:

Would you rather own the Mona Lisa or have a high-paying job at Goldman Sachs that pays $1 million a year?

We all know how valuable the Mona Lisa is or can be. Any rational person would choose it and try to auction it off. But here’s the catch: the auction won’t guarantee a specific price or timeline. You don’t control the market or the moment of liquidity (when it converts to cash). A job, on the other hand, gives you predictable income—$1 million, like clockwork.

Still, the Mona Lisa path represents true wealth. You’re asset-rich. You don’t need to show up at an office or trade time for money. The value sits with you even while you sleep, and you know you can sell it.

Now let’s compare it to holding gold.

Would you rather have $1 billion in gold or earn $1 million a year at Goldman Sachs?

Another no-brainer. With $1 billion in gold, you can sell it relatively quickly. It’s a liquid asset. You don’t need to work. You’re asset-rich. The value sits there, silently, while you sleep.

In both cases—whether it's a rare painting or gold—you own something of value. You don’t trade your time to preserve it. It holds its worth on its own sitting in a warehouse somewhere.

Now compare that with the alternative:

Waking up at 6 a.m., putting on a suit, shaving, obsessing over spreadsheets and pitch decks, meeting clients you may or may not enjoy, sacrificing time with family, and grinding through 80-hour weeks—for a $1 million paycheck.

The difference is clear. One is freedom. The other is rent.

Now let’s compare this to owning a company.

What happens when someone quits their job to pursue their own entrepreneurial endeavor?

To understand this, you have to first understand what it means to own a company. A company is a group of people working together toward a common goal—a shared vision and mission. To bring that vision to life, you have to register the company and invest in key assets: people, brand, and technology. The end goal is to fulfill that mission.

Once the company is operational, it carries a certain value depending on how successful it is. That value is determined by how well the company performs fundamentally.

So why would someone leave a high-paying job to become an entrepreneur?

There’s one financial reason: they believe the future value of the company they’re building will far exceed what they could earn as a salaried employee, and they enjoy what they do at the same time. So it is both financially rewarding and fun to do. Otherwise, why do it?

Sure, you can love what you do with no attachment to financial gain. But over time, human desire tends to drift toward wealth. As Adam Smith famously said “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.”

Let’s fast forward to the future.

Say you know that in 7 years, your company will be worth $500 million. It has already made it past the valley of death (that early stage where most startups fail) and a conservative estimate puts the realization of that value just 7 years away.

Now imagine Goldman Sachs offers you a job today with a $1 million annual salary.

The catch? You have to leave the company you started and give up all future upside.

Should you take it?

At the moment, you're paying yourself minimum wage. You have no real benefits (maybe just insurance) and no guarantees. But you know what your company is worth, because investors have validated it. You’ve seen the numbers. You’ve seen what it can become. And better yet, you love what you do.

So what’s more valuable: a guaranteed high salary now, or asymmetric upside later while enjoying what you do?

Most smart entrepreneurs would not take the Goldman offer. In fact, I wouldn’t even call it smart. I would consider it not being stupid. Not only does owning a company provide you with a much larger future outcome, but it also give you a path to freedom. Something a job will never give you. So in this case let’s compare two options:

Option 1: The $1M Job

Salary: $1 million per year

Conditions:

Wake up at 6 a.m.

Wear a suit

Commute to a fancy office

Obsess over spreadsheets and pitch decks

Sell to clients you may or may not even like

Work 80-hour weeks

Assets: 401(k), savings, ETFs—worth $1M, growing at ~8% annually

End State: Retirement when you are 60

Option 2: The Founders Path

Salary: $50,000/year (first two years: $0)

Conditions:

Wake up whenever, work wherever, with whoever, on whatever you want to fulfill your mission.

Build something you love, aligned with your mission

No separation between work and play because it’s all play to you

Assets: A company worth $15M today, with a conservative future value of $500M in 7 years

End State: None. You don’t retire. You just keep going, because you’re doing what you love

Now the difference between the two paths is that option 1 is a path of high income and high liquidity, but less wealth. Sure you can buy your Ferrari, your swanky apartment, designer clothes, and live that life. While option 2 is a path of low income but extreme wealth. For the next 7 years, your wealth is tied to your company and you will have to live frugally just to get by. But you are still wealthier than the guy with the $1M a year salary.

Here is a video of Jeff Bezos in 1999:

What’s interesting is that Bezos’s net worth at the time was around $10 billion, as Amazon’s stock had skyrocketed during the dot-com craze, despite having gone public just two years earlier.

I don’t know why this surprises people. He started Amazon in 1994 after quitting his high-paying job at D.E. Shaw, a hedge fund, and took the company public in 1997. For those five years (until 1999) he lived a frugal life for the sake of the company.

Sure, today he buys mega yachts, mansions, and whatever else he wants. But that’s only because he can now sell shares on the open market whenever he chooses (Amazon doesn’t pay dividends), and the company is mature, generating strong cash flows with solid management in place.

His official salary today? Just $81,840 per year.

Bezos understood the concept of compounding and wealth the same way Buffett understood it at the age of 11. The sooner you understand it, the brighter your future will be.

Here is an interesting video of Garry Tan from Y Combinator explaining what it means to be rich:

In the video he says “Money is not wealth. As Paul Graham says “Don’t get hung up by the money. It only represents wealth.” If you are focused on the money, you’re only going to get stuck as a COG in the machine. You’ll end up focused on that next promotion. Or the trappings of upward job mobility. What is far more valuable is to create and own that engine.” If you have time, please watch the entire thing. I would argue that 95% of the people I speak to think wealth is the opposite, where money is the the main determinant. Watching this gives you an edge being in that 5%, and the video is free for everyone to watch.

But what Garry Tan doesn’t talk about is how to manage liquidity as a founder. That’s because in the video he makes the argument that buying nice things is not the way to wealth. But I think liquidity is still something worth discussing.

He makes reference to Warren Buffett (yes as an early stage investor he has gone to the Berkshire event) and to guys like Naval Ravikant, who encourage wealth building over anything else.

“Seek wealth, not money or status.

Wealth is having assets that earn while you sleep.

Money is how we transfer time and wealth.

Status is being held in high regard by your peers.

Wealth is freedom. Status is an illusion.

- Naval Ravikant

Naval Ravikant is an early stage investor in Silicon valley, and he has backed groups like Uber, FourSquare, Twitter, and is the founder of AngelList, a unicorn. He has found early success through these methods and has even collaborated with Eric Jorgenson to publish a book (The Almanack of Naval Ravikant) that teaches two things that most schools don’t teach: Wealth and Happiness.

If you are interested in this topic, there is a goldmine of ideas in the following playlist:

I’m not one to read a bunch of self-help books. But when you’re in business and you follow respected leaders who have built significant wealth over their lifetimes, you start to listen to their advice. Many of them eventually share their views through books or podcasts. Jeff Bezos, Naval Ravikant, Paul Graham, Garry Tan, Warren Buffett, the Collison brothers, and even Elon Musk, all follow these principles, despite having widely different business philosophies.

The common denominator? They all understand the power of compounding and what it truly means to build wealth.

And the best part? These lessons are all free on the internet.

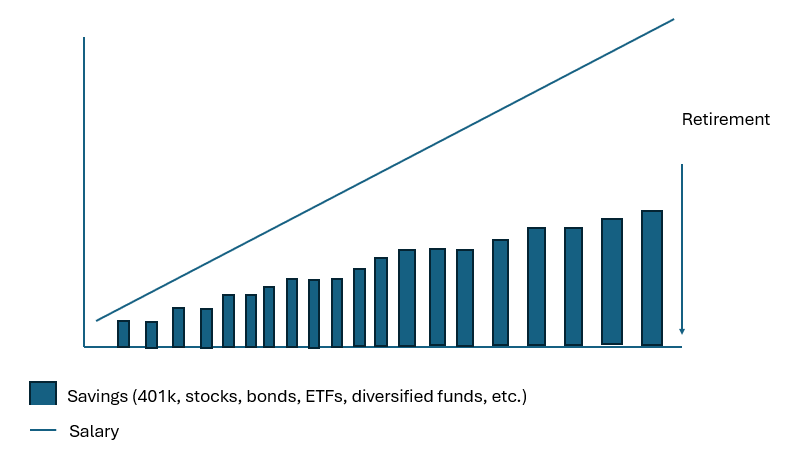

The title of this essay is Portfolio Management for Founders, so you might be wondering how this relates to portfolio management. Well, the standard practice of portfolio management is to put away a portion of your income monthly into a savings or diversified investment account that grows gradually over time at a reasonable interest rate, so you end up having consistent earnings, and then consistent growth of wealth over time, and then you retire. It looks something like this:

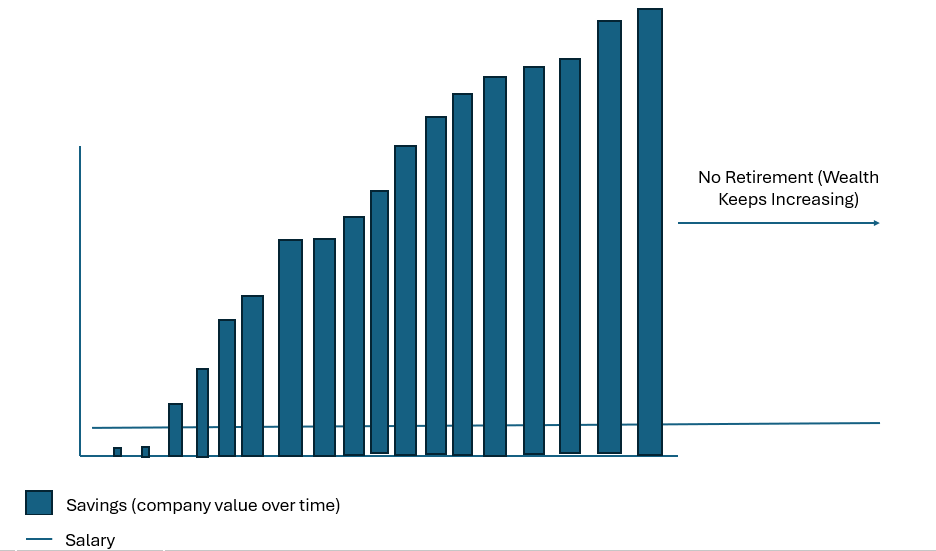

And this is what it looks like if you leave your job to start your own company, assuming that the company does well over time:

You will notice something different on the second graph. The salary line is flat. This is because most founders do not get a proper salary. Many of the best ones get the bare minimum, because they know that the value they get is from their ownership in the company (bar graph). The big difference here is liquidity. For a salaried person, he knows he could sell his stocks or liquidate his diversified funds to get cash, while a founder would have to find an exit or sell secondaries to the market. Sure, that is more difficult than simply selling your public stocks, but when you are worth $500m, I think there is a pretty good chance you can find ways to do it.

So how does a founder spend his money? I think it is safe to say that founders have every right to spend every cent of their salary, so long as they (and their families ) are covered by insurance. Their savings is in the form of equity in their companies. This is very different from saving a portion of your salary to invest it in traditional funds.

Let’s not forget Walmart was founded by Sam Walton in 1962, and the family has most of its wealth in its own stock through Walton Enterprises LLC. It was a very illiquid stock at the time of its founding (private company with no proven record). Today, the family still owns ~46% of the company, making them worth $432 billion, the richest family in the world. All this wealth is purely from stock ownership, not salary. Bezos, Buffett and Musk did the same and continue to pursue this strategy.

The next time you see someone flaunting that Ferrari, or talking about his next big salary, or the next bonus check, or the new Rolex, be careful judging based on these possessions. True wealth is often invisible. And more often than not, it's built quietly through ownership and equity that compound while you sleep.

ABOUT THE AUTHOR

Keenan Ugarte is Managing Partner at DayOne Capital Ventures, an independent private holding company that invests in and builds high-growth, early-stage businesses that serve the underserved Philippine mass market. He is also the Co-Founder of The Independent Investor, a media platform spotlighting early-stage companies and innovation within the Philippine startup ecosystem.