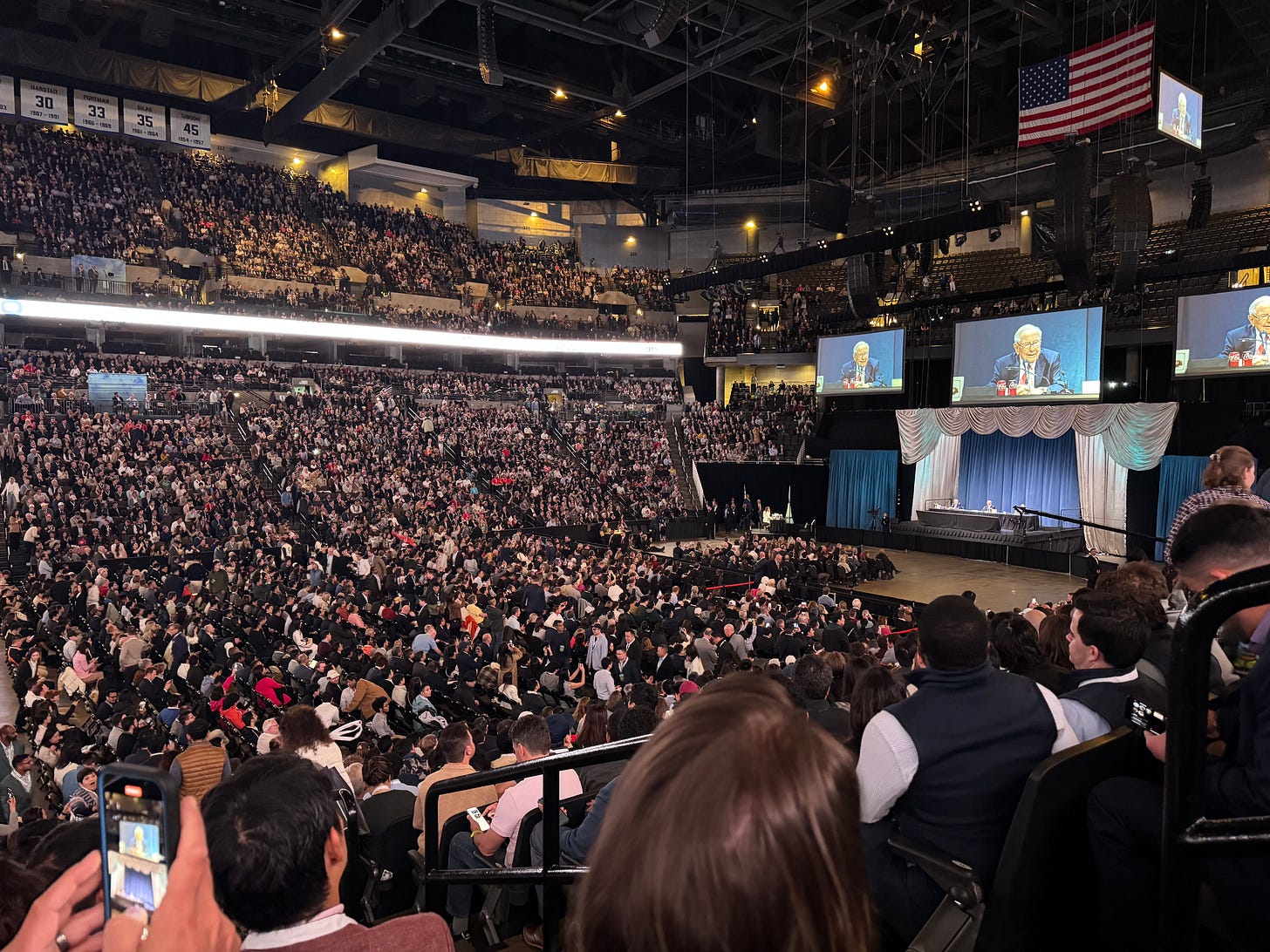

As I was watching the 2025 Berkshire Annual Shareholder Meeting and listening to Warren Buffett speak, I couldn’t help but jot down some key notes that offered insight and wisdom (with humor). Here are some of the best lines I gathered from my own notes and others:

Warren Buffett

“I am somewhat embarrassed to say that Tim Cook has made Berkshire a lot more money than I’ve ever made Berkshire Hathaway”

“Nobody but Steve could have created Apple, but nobody but Tim could have developed it as he has.”

“I was just looking through a handbook that had about 2 or 3 thousand Japanese companies in it. What stood out was: there were these five trading companies selling at ridiculously low prices. So I spent a year acquiring them. We told them, as we were getting close to 10% ownership, that we would never exceed that without their permission. It is now in the process of being relaxed, and I could say in the next 50 years; we won’t give a thought about selling those positions.”

“Greg is more cosmopolitan than I am, but that doesn’t say much”

“We plan to hold them (Japanese trading houses) for 50 years or forever… We really hope to do big things with them globally”

“The Japanese trading houses are up our alley”

“Size is an enemy of performance, and I don’t know any good way to solve that problem at Berkshire”

“This all happened because I was looking through a handbook. It’s amazing what you can find when you turn the page. I would say turning every page is one important ingredient to bring to the investment field. Very few people do, and the ones who turn every page aren’t going to tell you what they find. So you’ve got to do a little of it yourself”

“The amount of cash we have - we would spend $100 billion if something is offered that makes sense to us. The problem with this business is that things don’t come along in an orderly fashion, and they never will”

“The process of leafing through things like that big Japanese book… that’s a treasure hunt. Every now and then you find something. Occasionally, very occasionally - but it’ll happen again. I don’t know when. It could be next week. It could be 5 years from now, but it won’t be 50 years off - we will be bombarded with offerings that we’ll be glad we have the cash for.”

“It would be a lot more fun if it would happen tomorrow, but it’s unlikely to happen tomorrow. The probabilities go higher as you go along. It’s kind of like death - if you’re 10 years old, the chances that you’re going to die the next day are low. If you get to be 115, it’s almost a certainty, particularly if you are a male, as all longevity records are held by females. I tried to get Charlie to have a sex change so he could test out whether it would extend his life. He did pretty well for being a male.”

“In respect to real estate, it’s so much harder than stocks in terms of negotiation of deals, time spent, and the involvement of multiple parties in the ownership. Usually when real estate gets in trouble, you find out you’re dealing with more than just the equity holder.”

“When you walk down the New York Stock Exchange, you can do billions of dollars worth of business, totally anonymous, and you can do it in 5 minutes. In real estate, when you make a deal with a distressed lender, that’s just the beginning. Then people start negotiating more things, and its a whole different game with a different type of person who enjoys that game”

“We have seen huge failures in real estate.”

“We find it much better when people are ready to pick up the phone and you can do hundreds of millions of dollars worth of business in a day. I’ve been spoiled, but I like being spoiled, so we’ll keep it that way”

“I wouldn’t trade everything that’s developed in AI in the next 10 years for Ajit. If you gave me a choice of having a hundred billion dollars available to participate in the property casualty insurance business for the next 10 years and choice of getting the top AI product from whoever’s developing it or having Ajit making the decisions. I would take Ajit anytime - and I’m not kidding about that.”

“Marmon owns over 100 companies and it was remarkable when we bought it. So its something of a Berkshire within Berkshire.”

“We’re always in the process of change, and we’ll always find all kinds of things to criticize in the country. But the luckiest day in my life is the day I was born, because I was born in the United States. If you don’t think the United States has changed since I was born in 1930, you’re not paying attention. We’ve gone through all kinds of things - recessions, world wars, the development of the atomic bomb. So I would not get discouraged about the fact that we haven’t solved every problem that’s come along”

“If I were born today, I would just keep negotiating in the womb until they said I could be in the United States.”

“The trick when you get in business with somebody who wants to sell you something for $6 million that’s got $2 million of cash, a couple million of real estate, and is making $2 million a year, is you don’t want to be patient at that moment. You want to be patient in waiting for that call. My phone will ring sometimes with something that wakes me up. You just never know when it’s happen”

“It’s a combination of patience and a willingness to do something that afternoon if it comes to you. You don’t want to be patient about acting on deals that make sense, and you don’t want to be very patient with people talking to you about things that will never happen”

“Both Charlie and I just enjoyed the fact that people trusted us. They trusted us 60 or 70 years ago in partnerships we had. We never sought out professional investors to join our partnerships. Among all my partners, I never had a single institution - I never wanted an institution. I wanted people. I didn’t want people who were sitting around having presentations every three months and being told what they wanted to hear"

“The interesting thing about auto insurance is that we’re selling the same product as in 1936 when the company was started. GEICO is a fascinating story. About three times over the years, the company has gotten sidetracked one way or another and then gotten back to basics. It’s a wonderful business”

“You get a few breaks in life in terms of people you meet who just change your life dramatically. If you’ve had a handful of those, you treasure them. We’ve had them on this board of Berkshire. You just listen to them carefully. That comes in the category of “turn every page.” You just get lucky in life, and you want to take advantage of your luck.”

“You really want to work at something you enjoy. I’ve had five bosses in life and I liked them. They were all interesting. I still decided that I’d rather work for myself than anybody else. But if you want people that are wonderful to work with, that’s the place to go. I’ve told my kids basically that you don’t get lucky like I did when I found what interested me at seven or eight years of age. It could have taken much longer, but you want to find what you love.”

“Don’t worry too much about starting salaries and be very careful who you work for because you will take on the habits of the people around you. There are certain jobs you shouldn’t take”

“If stupid things are happening around you, you don’t want to participate. If people are making more money because they’re borrowing money or participating in securities that are pieces of junk but they hope to find a bigger sucker later on, you have to forget that. That’ll bite you at some point. The basic game is so good, and you’ve been so lucky to be born now”

“If I’d been born in 1700, I’d say, “I want to go back in the womb. What the hell with this? It’s too hard.” But now I’ve come along to do something where I can just play around all day with things I enjoy doing. It’s a pretty wonderful life.”

“And to the gentleman who asked the question, if you don’t find it immediately, don’t starve to death in the meantime, but you will find it. It’s something like finding the right person in marriage - you may not marry the person you met on your first date. Sometimes it pays to wait.”

“We don’t do anything based on its impact on quarterly and annual earnings. There’s never been a board meeting I can remember where I’ve said, “If we do this, our annual earnings will be this, therefore we ought to do it." The number will turn out to be what it’ll be. What counts is where we are five or 10 or 20 years from now”

“That’s the big thing we worry about with the United States currency. The tendency of a government to want to debase its currency over time. There is no system that beats that. You can pick dictators, you can pick representatives, you can do anything, but there will be a push toward weaker currencies.”

“There are people that want to copy Berkshire’s model, but usually they don’t want to copy it by having all of their money in the company forever. They have a different equation - they’re interested in something else.”

“Who you associate with is just enormously important. Don’t expect that you’ll make every decision right on that, but you are going to have your life progress in the general direction of the people that you work with, that you admire, that become your friend…You want to hang out with people that are better than you are and that you feel are better than you are because you’re going to go in the direction of the people you associate with. That’s something you learn later in life. It’s hard to really appreciate how important some of those factors are until you get much older.”

“I would try to be associated with smart people too where I could learn a lot from them, and I would try to look for something that I would do if I didn’t need the money. What you’re really looking for in life is something where you’ve got a job that you’d hold if you didn’t need the money, and I’ve had that for a very long time.”

“It’s interesting to me that in the investment business, so many people get out of it after they’ve made a pile of money. You really want something that you’ll stick around for whether you need the money or not. I think a happy person lives longer than somebody that’s doing things they don’t really admire that much in life.”

“If I came from 20 generations of shepherds, I think I’d get kind of tired of looking at sheep every day. Everything in life has been made so much better. You’ve got to figure that you drew a lucky straw by staying in the womb for a couple hundred thousand years and then emerging at the right time”

“I would focus on the things that have been good in your life rather than the bad things that happen, because bad things do happen. It can often be a wonderful life even with some bad breaks.”

“For 94 years I’ve been able to drink whatever I want to drink. They predict all kinds of terrible things for me, but it hasn’t happened yet. If you look at the lifespan of professional athletes after a while, you really decide that you’re better off if you weren’t the first one chosen to be on the baseball team or the basketball team.”

“Charlie and I never really exercised that much or did anything - we were carefully preserving ourselves”

“We expect change in all our businesses. If the game didn’t change, it really wouldn’t be very interesting. If every time you swung at a baseball you hit a home run, or every time you hit a golf ball you had a hole-in-one, it wouldn’t be interesting.”

“It’s a dynamic world. The biggest thing we have to worry about, unfortunately, is that we’ve learned how to destroy the world too. We’ve got this wonderful world, but now we know there are eight countries - and probably a ninth coming - that can destroy it, and we don’t necessarily have the perfect people leading each of those countries.”

“I spend more time looking at balance sheets than I do income statements. Wall Street doesn’t pay much attention to balance sheets, but I like to look at balance sheets over an 8 or 10 year period before I even look at the income statement. There are certain things that are harder to hide in balance sheets”

“We will build the earning power but it won’t come in an even stream. But that’s what makes it a good business. The more fearful other people get, the better your opportunities get.”

“It’s always better to make a lot of money without putting anything than it is to make a lot of money by putting up a lot of money”

“It’ll be interesting to see how much capital intensity there is now with the Magnificent 7 compared to a few years ago. Basically, Apple has not really needed any capital over the years… and has used its money to repurchase shares. Where this world is the same in the future. I don’t know. It’s something to be seen”

“The trick in life is to get somebody else’s capital and get an override on it. Charlie and I decided it wasn’t too elegant a business after a while. It just didn’t appeal to us after a while. I did it for 12 years though. The one difference that Charlie and I did from other people is we put all our own money into it as well. So we really did share the losses. Using other capital. It’s a great business but it leads to abuse.” (talking about the fund management business).

“Capitalism in America has succeeded like nothing you’ve ever seen. It is a combination of this magnificent cathedral which has produced an economy like nothing the world’s ever seen, and then it’s got this massive casino attached to it…. In the casino, everybody’s having a good time and there’s lots of money. The temptation is very high now to go over to the casino where people say we’ve got magic boxes and all kinds of things that’ll do wonderful things for you…. The balance between the casino and the cathedral. It’s important that the United States in the next 100 years makes sure that the cathedral is not overtaken by the casino. People really like casinos. It’s just much more fun. It’s designed to move money from one pocket to another.”

“In the cathedral, it designs things that produce real goods and services for 300 and some million people. It keeps going. It’s an interesting system and it works. The idea that people get what they deserve in life. It’s hard to make that argument. But if you argue with it that any other system works better, the answer is we haven’t found one”

“The teachers you get in your life have an incredible impression on you. Some are formal teachers and some are informal. You really hope you’re learning from everybody you find who’s well-intentioned and has had a lot of experience. I had a lot of good luck in that… As Charlie would say, people would always ask, “If you could only have lunch with one person living or dead, who would it be?” And Charlie said “I’ve already had lunch with all of them because I ‘ve read all their books”.. I think having curiosity and finding sympathetic teachers is very useful. I ran into a couple of teachers both in high school and college. At each place I went to I found about two or three really outstanding people. I just spent my time with them and didn’t pay much attention to the other classes.”

“Minds are really different. I watch great bridge players, great physicians. People have different talents. I think you’re supposed to have 88 billion cells in your brain. I’m not sure that all of mine are flashing bright lights, but you are different than anybody else. That’s what my dad always used to tell me - that you’re something different. It may be good at the moment, but you find your own path and you will find the people in schooling that want to talk to you. I wouldn’t try and be somebody else.”

“It scares me to some extent about what the future of the currency will be, because they can print currency. If you have people that get elected by promising people things. That doesn’t mean that they aren’t sincere about all kinds of items, but there’s no politician that says to anybody that has money, “I really think you have bad breath and if you don’t mind, would you step away from me.” It just doesn’t happen.”

“I have no intention, zero, of selling one share of Berkshire Hathaway. It will be given away”

Ajit Jain

“AI will be a game changer. It will change the way we assess risk, we price risk, and then the way we end up paying claims. However, I certainly also feel that people end up spending enormous amounts of money trying to chase the next fashionable thing. We are not very good at being the fastest or the first mover. Our approach is more wait and see where we have a better view in terms of failure, upside, and downside.”

“Private equity firms are taking on specific risk both in terms of leverage and credit risk. While the economy is doing great and credit spreads are low, these firms have taken the assets from very conservative investments to ones where they get a lot more return. As long as the economy is good and credit spreads are low, they will make money - they’ll make a lot of money because of leverage. However, there is always the danger that at some point the regulators might get cranky and say they’re taking too much risk on behalf of their policyholders, and that could end in tears. We do not like the risk-reward private equity is offering, and therefore we put up the white flag and said we can’t compete in this segment right now.”

Greg Abel

“We will remain Berkshire and will never be dependent on a bank or some other party for Berkshire to be successful. With allocation of capital comes management of risk and understanding risk.”

“The next opportunity is to acquire businesses in their totality, 100%”

And the standing ovation…