When I speak to people about startups and ideas, most claim that you need something entirely revolutionary to win a market. They assume markets are so efficient that only groundbreaking products can succeed. But what does it mean to be revolutionary? How do we measure whether something truly is?

There are many arguments around this, but I believe the single defining factor is the number of lives it impacts, and how effectively that impact translates into revenue for your company. This is what investors call product-market fit.

What is product-market fit? What does it mean to build a product that stands the test of time and changes the world?

Everyone wants to be like Elon Musk, Sam Altman or Jeff Bezos, but their paths are just some of many ways to create something revolutionary. What about Sam Walton of Walmart or Ingvar Kamprad of IKEA or Peggy Cherng of Panda Express? Their businesses have shaped the world in a big way, if not more. They didn’t do it through cutting-edge technology but by offering something radically simple and accessible while maintaining quality and service.

What is clear is that the path to product-market fit is not the same for all services, and Sequoia outlines this well in their article The Arc: Product-Market Fit Framework, stating:

Ultimately, product-market fit is about your product’s place in the world. There are different aspects to how your product fits into the world that you could hone in on—competitive landscape, the technical merits of your product, etc. We think the best way is to start by focusing on how the customer relates to the problem your product solves.

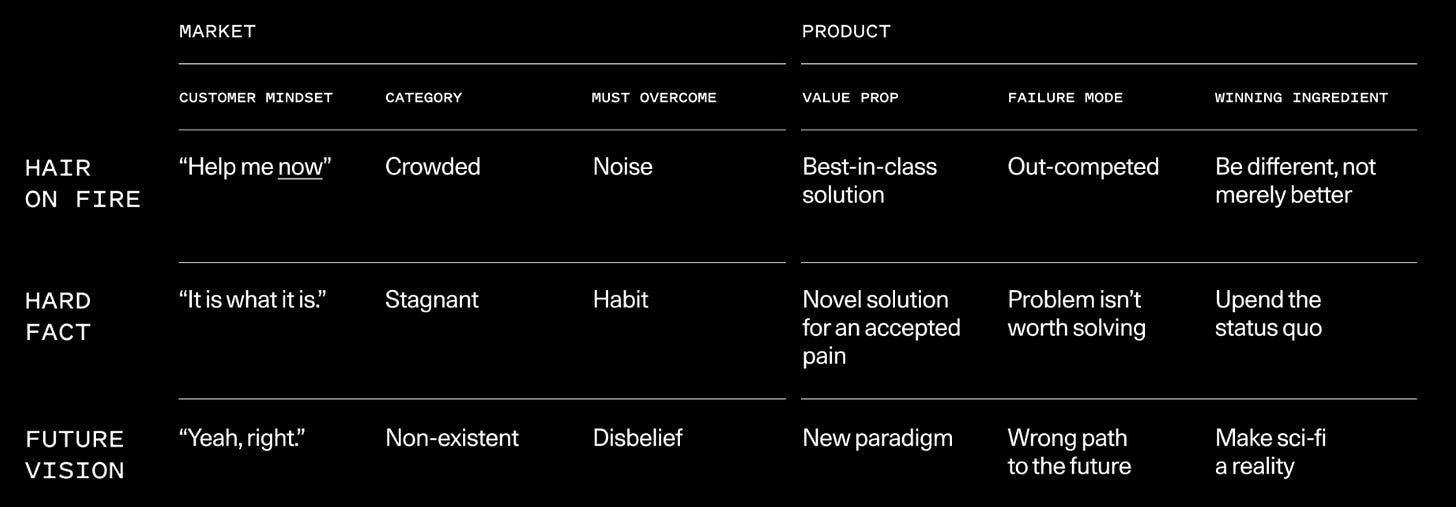

In the article, they mention three types of product market fit: Hair on Fire, Hard Fact, and Future Vision.

A summary of each is as follows:

Hair on Fire: these are urgent needs that customers need better solutions for and usually in a crowded and existing market. In this category, a product will have to win in price, quality, and service, and be differentiated enough to keep a lasting moat. In other words, these are simpler solutions that improve the status quo or offer something similar to what is already existing, but much better.

Hard Fact: these are problems that are large and annoying but too complex to solve. These problems exist and are just “part of life” and are usually taken for granted. AirBnB is an interesting example of convincing users that staying in a strangers house is ok and could even save money. People would have thought of them as stupid initially.

Future Vision: these are products that customers themselves don’t think they even need, because they haven’t done it before. And when they are proposed, they are dismissed as impossible to achieve. Think Elon Musk and Mars (Spacex), Peter Thiel and life extension technology (Unity Biotechnology). Wild ideas that push the boundaries of what we know.

If you look at the column under "Customer Mindset" in the picture above, you'll see that the three types of reactions are: "Help me know," "It is what it is," and finally, "Yeah, right." What many people assume is that for a startup founder to succeed, they must achieve the "Yeah, right" reaction. These inventive people are often considered geniuses. Those who build space rockets, iPhones, social networks, and so on. But is that truly what defines genius? What is a genius, anyway?

I asked ChatGPT to define a genius and this is what it gave: “A genius is someone who demonstrates extraordinary intellectual ability, creativity, or originality, often in a way that profoundly impacts their field or the world. Genius isn't just about high intelligence—it’s about seeing and solving problems in ways others don’t, making connections that others miss, and often being ahead of one’s time.”

I would consider people like Mrs. B, Sam Walton, Danny Meyer, and Ingvar Kamprad geniuses. I doubt they were exceptionally skilled in math and technology, but they built something unique and impactful to the world that nobody realized until later. However, their businesses weren't Future Vision businesses; they fall under Hair on Fire. These are businesses customers know but recognize as offering something different and unique in terms of quality and customer experience. To me, there’s more genius in that than in some trendy AI startup with poor fundamentals.

Why am I saying this? In the first world, where markets are more efficient and competition is fiercer, startups are more likely to succeed by operating in the Future Vision category. They push beyond the boundaries of existing knowledge. Most people are well-educated, connected to strong knowledge networks, and aware of multiple ways to satisfy customers with variations of the same product.

This makes it difficult to build a differentiated business in an existing market without attracting other smart entrepreneurs who will quickly enter your space. While there are plenty of Hair on Fire businesses in the U.S., the ones that truly move the needle tend to fall under Future Vision. They introduce groundbreaking innovations rather than incremental improvements. Just look at the composition of the S&P500 today, with over 30% of the companies in technology, making it the largest sector within the index.

In emerging markets and poorer countries, the opposite is true. In places like the Philippines, where public science and educational programs are limited or sometimes nonexistent, building specialized startups that revolutionize technology is far less likely. What are the chances that a graduate from a local university in the Philippines can outcompete a Stanford PhD in AI and engineering? Sure, it’s possible, but highly improbable. Searching for the next AI-driven B2B SaaS winner in the Philippines is an uphill battle. And even if you do find one elsewhere (say, in the U.S.), it has likely already been vetted by dozens of investors—making you the last in line.

However, what I find most interesting is the Hair on Fire category in the Philippines. We have a $450 billion GDP, with a significant portion driven by the mass market. This market is filled with businesses offering generic products with little to no differentiation—yet, they continue to thrive, filling the pockets of lazy entrepreneurs. This only means that people in our markets have no other options.

When we drive around cities in the Philippines, it’s easy to point out things we wish we had: better burgers, better sandwiches, better ice cream, better bread, better schools, better hospitals, better roads—you name it. The list is endless. And yet, the economy continues to grow, expanding by 5.6% in both 2023 and 2024.

I believe the startup narrative in the Philippines needs to shift toward practical improvements—focusing on what we can enhance rather than chasing moonshots. There is tremendous room for incremental change that can create lasting impact, both in the communities we serve and in the alpha generated from investments, with many of these opportunities right in front of us.

As Sequoia points out, product-market fit isn’t a one-size-fits-all path. There are different ways to succeed as a startup, and in our market, customer connection matters more than technology-first solutions. The most realistic approach isn’t just about innovation for the sake of innovation, but about how customers relate to the problem your product solves. Many of these problems are basic in nature, yet they remain ripe for disruption.

We have to remember that some of the greatest entrepreneurs in history simply wanted to solve problems that bothered them. Steve Jobs once said, “Make something you want to use yourself.” In the first world, where everyone is somewhat on a level playing field (with similar tastes), this might hold true.

Unfortunately, in emerging markets like the Philippines, we can’t assume that our tastes will match those of the markets we serve—or risk shooting ourselves in the foot. That’s where the alpha is. It’s in the pockets that most of us ignore because they are problems we don’t personally face. Success in emerging markets means stepping outside your comfort zone, understanding what the mass market truly wants, and placing yourself in their shoes to experience real pain points we might overlook. You’d be surprised at the gaps you’ll find—and you’ll quickly realize the problems are far bigger than conventional wisdom assumes.

ABOUT THE AUTHOR

Keenan Ugarte is Managing Partner at DayOne Capital Ventures, an independent private holding company that invests in and builds high-growth, early-stage businesses that serve the underserved Philippine mass market. He is also the Co-Founder of The Independent Investor, a media platform spotlighting early-stage companies and innovation within the Philippine startup ecosystem.