Fundraising: The Rule of 72 (Part 1)

Why the rule of 72 is the foundation of early-stage valuation

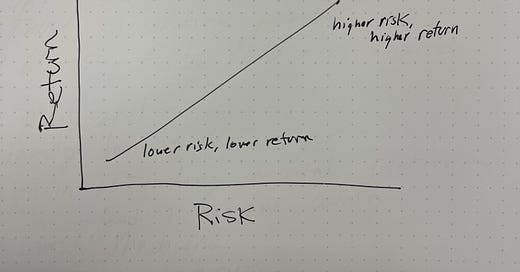

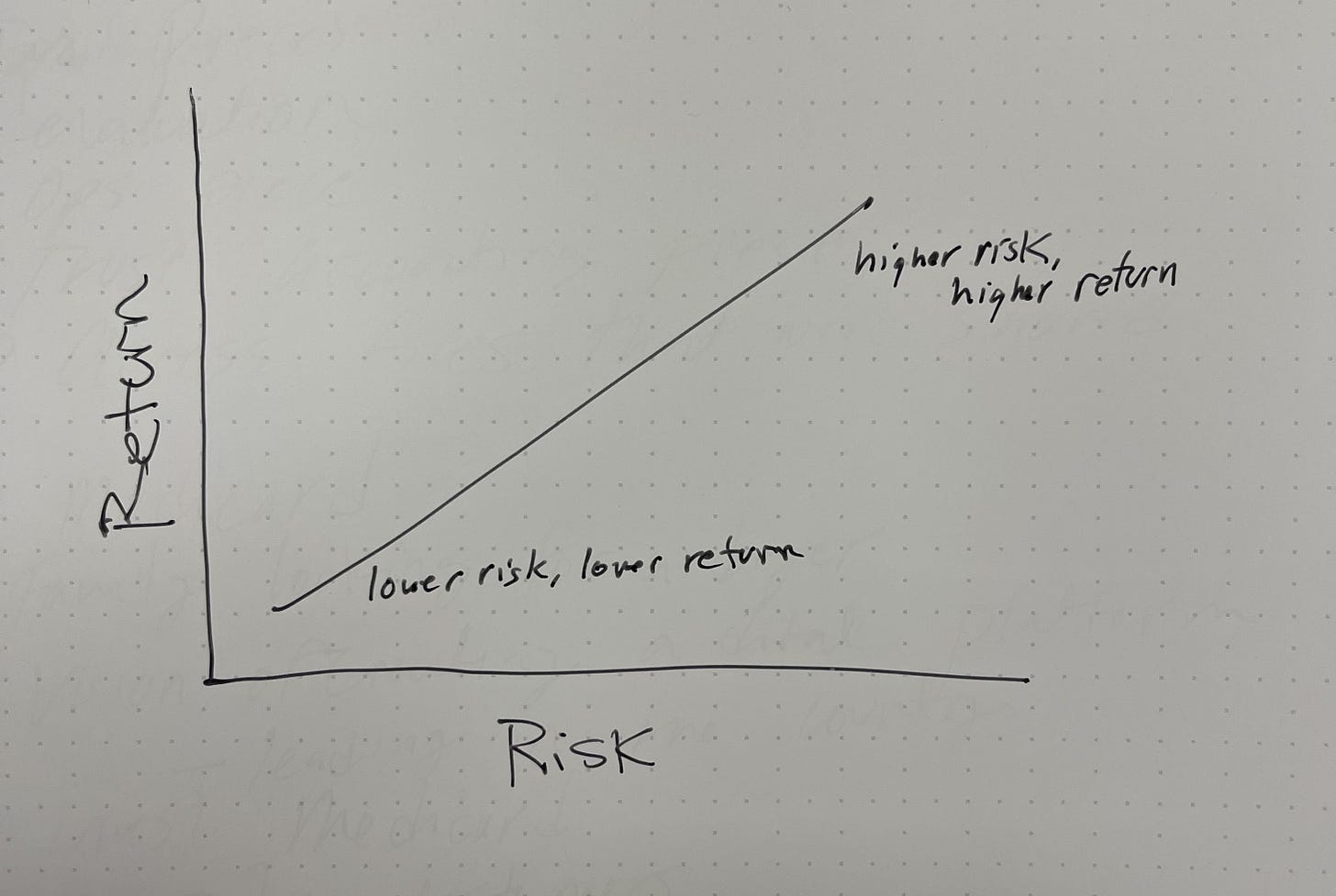

When someone invests in a new project or company, there is always an expectation of return. Each person will have their own ideal risk/return curve depending on their preferences.

This is why when people ask if there is a “correct” valuation, I prefer to say that the only thing that is correct is the formulas used to arrive at a valuation (which can be …

Keep reading with a 7-day free trial

Subscribe to The Solo Capitalist to keep reading this post and get 7 days of free access to the full post archives.